pay ohio unemployment taxes online

Unemployment Compensation Tax - Frequently Asked Questions Who is an Employer. JFS-20106 Employers Representative Authorization for Taxes.

Update On Ohio Unemployment Phone Lines New Federal Assistance Wfmj Com

Ohio income tax update.

. If you already have an email address on file with the Department follow these steps to validate your email address. To file and pay online you can use either the ERIC system or the Ohio Business Gateway. Bank Account Online ACH Debit or Credit Card American Express Discover MasterCard or Visa from the Make Payment page.

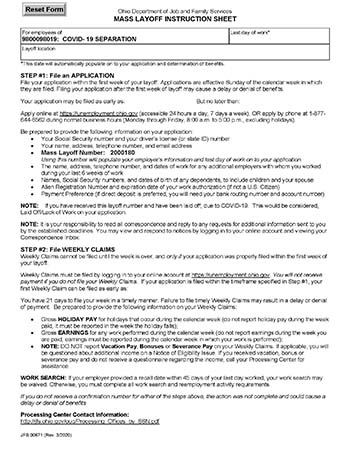

Ohio Department of Job and Family Services. Who is a Non-Profit Employer. Top Ten Home Alarm Systems Top Rated Home Security Companies Top 10 Best Security Systems.

Offer helpful instructions and related details about Pay Ohio Unemployment Taxes Online - make it easier for users to find business information than ever. In addition The SOURCE allows employers and third-party administrators to manage all their business related to unemployment contributions online including registering new businesses. As a result PUA claims are no longer being accepted.

Select the Payments tab from the My Home page. Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Taxes. Log into Online Services with your username and password.

Unemployment Tax Payment Process. Expand All Sections Web Content Viewer. If you need to file an appeal please visit PUAAjfsohiogov.

Report it by calling toll-free. If you have any questions or concerns about making a repayment please call 614-995-5691 option 3. The employer must file their school district withholding returns according to their filing frequency.

If the employer is unsure of their filing frequency they may contact the Ohio Department of Taxation at 1-888-405-4039 for verification. Mail the repayment to. Up to 25 cash back The two sections are considered a single report for filing purposes.

The SOURCE or the State of Ohio Unemployment Resource for Claimants and Employers is Ohios internet-based unemployment tax system. If you have an existing PUA account you still can access it by entering your Social Security number and password below. Changes in how unemployment benefits are taxed for tax year 2020.

Logon to Unemployment Tax Services. 2021 the Department of Taxation issued the tax alert Ohio Income Tax Update. Allows you to viewprint transcripts of previously filed returns up to 10 years and Ohio 1099-G1099-INT forms up to 5 years.

Its a one-stop shop where employers and third-party administrators can manage all their business related to unemployment contributions including registering new businesses filing quarterly reports and making tax payments among. Who is a Domestic Employer. If you are having problems logging in select the.

Using the online option reduces your tax return preparation time. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns. Enter your email address and click the Save button.

Please use the following steps in paying your unemployment taxes. Under Account Settings on. Authenticate Account to Establish Login Credentials.

If you have questions contact the Office of Unemployment Compensation Division of Tax and Employer Service at 614 466-2319. If you are an existing employer who has an OHIO UI account authenticate your account in the SOURCE application to establish login credentials by selecting the Authenticate my Account link below. Select a payment option.

Who is a Public Entity Employer. What is the difference between an E. JFS should send you preprinted forms.

Mailing address telephone number andor email address with the Department. The SOURCE Upload File. Unemployment benefits are taxable pursuant to federal and Ohio law.

When you enter wage information The SOURCE automatically calculates the taxable wages and contributions taxes due for you eliminating many common calculation errors. If you DID apply andor receive unemployment benefits from ODJFS. To file on paper use Form JFS-20125 Quarterly Tax Return which contains both required sections.

To submit your quarterly tax report online please visit httpsthesourcejfsohiogov. Beginning January 1 2018 employers are required to submit their quarterly reports electronically. Your account will be locked after 3 unsuccessful attempts.

Who is an Employee. Please review the various options employers have to submit their quarterly reports electronically. Who is an Agricultural Employer.

Apply for Unemployment Now Employee 1099 Employee Employer. You can also view outstanding balances if any and update certain contact information ie. Learn about Ohio unemployment benefits from the Ohio Department of Job and Family Services.

41 Our company received a letter stating that we may be overpaid on our account. Changes in how Unemployment. Also used by employers to authorize the Ohio Department of Job and Family Services to furnish information.

Education credits Guest Payment Service renaming of Ohio schedules and more. Updated 5262021 - Unemployment Benefits for Tax Year 2020. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19.

You can file your reports and payments online or on paper. Please visit httpsthesourcejfsohiogov to enter your quarterly reports online.

Ohio Income Tax Update Unemployment Benefits Whalen Company Cpas

New Hotline To Help Victims Of Unemployment Identity Theft Hamilton County Job Family Services

Did You Receive Any Of These Documents Ohio Unemployment Benefits Help

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Did You Receive Any Of These Documents Ohio Unemployment Benefits Help

Did You Receive Any Of These Documents Ohio Unemployment Benefits Help

Covid 19 Unemployment Benefits Hamilton Ryker

Ohio S New Unemployment Insurance Tax System Goes Live Dec 6 Business Journal Daily The Youngstown Publishing Company

Ohio Waivers Now Available For Pandemic Unemployment Overpayments Cleveland Com

Pua Unemployment Ohio Facebook

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

Labor Employment Alert Guidance On Ohio Unemployment Compensation Brouse Mcdowell Ohio Law Firm

Unemployment Insurance Ohio Gov Official Website Of The State Of Ohio

Some People Not Receiving Unemployment 1099 G Tax Forms

Ohio Department Of Job And Family Services Filing For Your Weekly Unemployment Benefits Youtube

Guide To Ohio Unemployment Insurance Benefits

Usaa Mobile Login Mobile Usaa Com Banking Deposit App Mobile Login